Tvm annuity calculator

Students may use this app as a TVM solver to. The Annuity Payout Calculator only calculates fixed payment or fixed length two of the most common options.

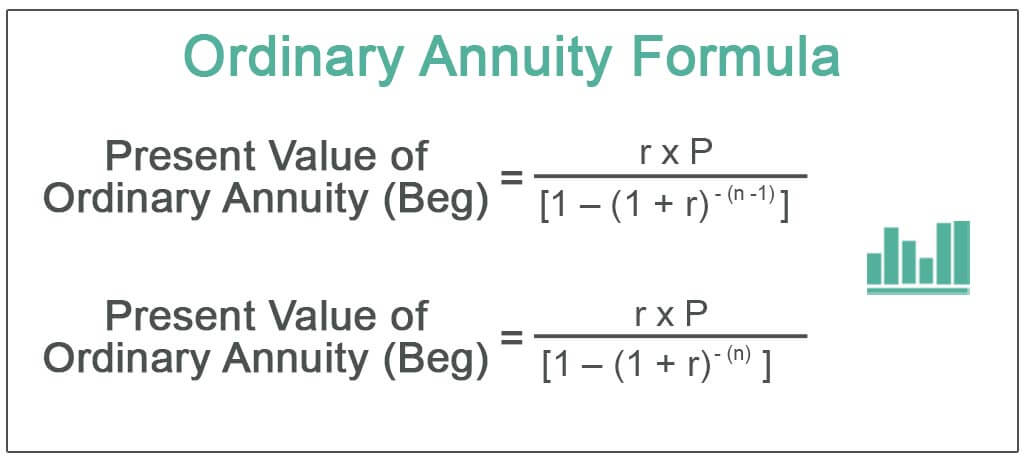

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Time Value of Money comprises one of the most significant concepts in finance.

. Present value PV future value FV annuity or cash flow amount interest or discount rate term or number of periods This free TVM. The idea focuses on identifying the real value of cash flows Cash Flows. In order to be able to add annuity.

All TVM calculations involve solving for one of five key variables. A time value of money tutorial showing how to calculate the future value of regular annuities using formulas. The five primary time value of money calculations are.

Tvm time value of money calculator calculates value of money in a given amount of interest earned over a given amount of time including the present value or future value of a cash flow or. Both are represented by tabs on the calculator. The present value of an ordinary annuity can be calculated as the present value of the first payment plus the present value of the second payment and so on.

Present Value Time Value of Money Calculator Answer 000 Format decimal points. TVM Time Value of Money Calculator calculates value of money figuring in a given amount of interest earned over a given amount of time including the Present Value or Future Value of a. This is a advanced financial calculator for undergraduate finance majors MBA students finance professionals and personal finance enthusiasts.

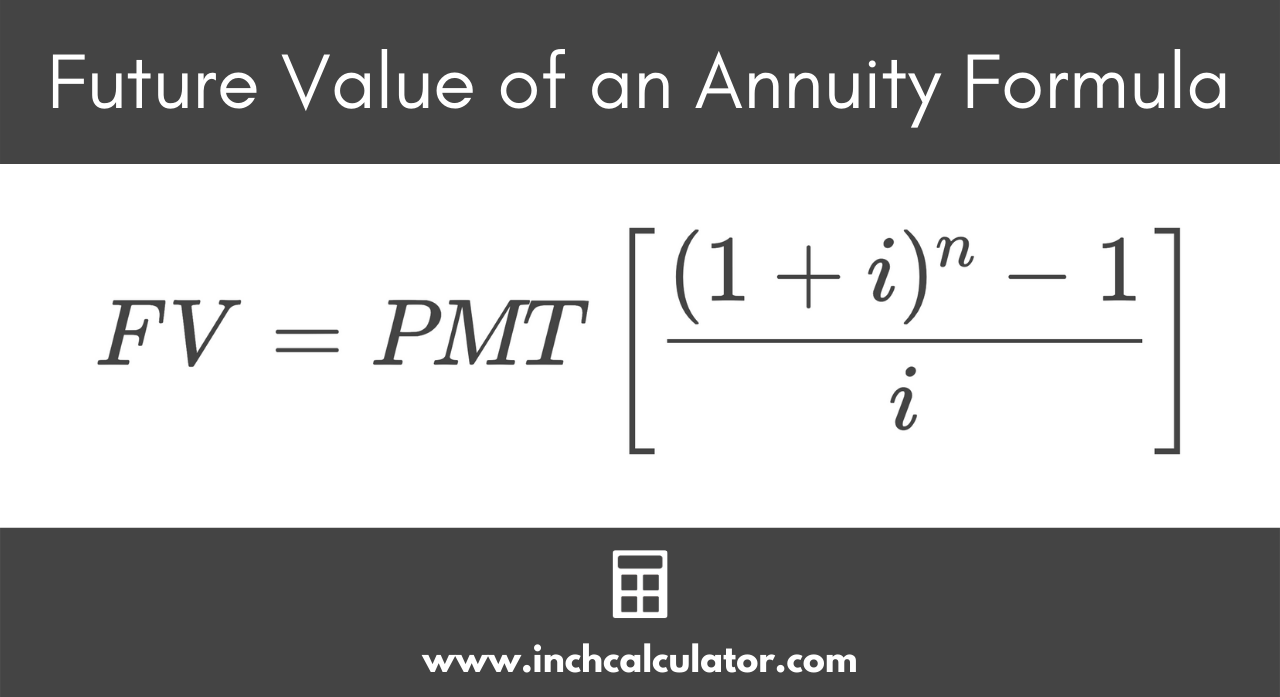

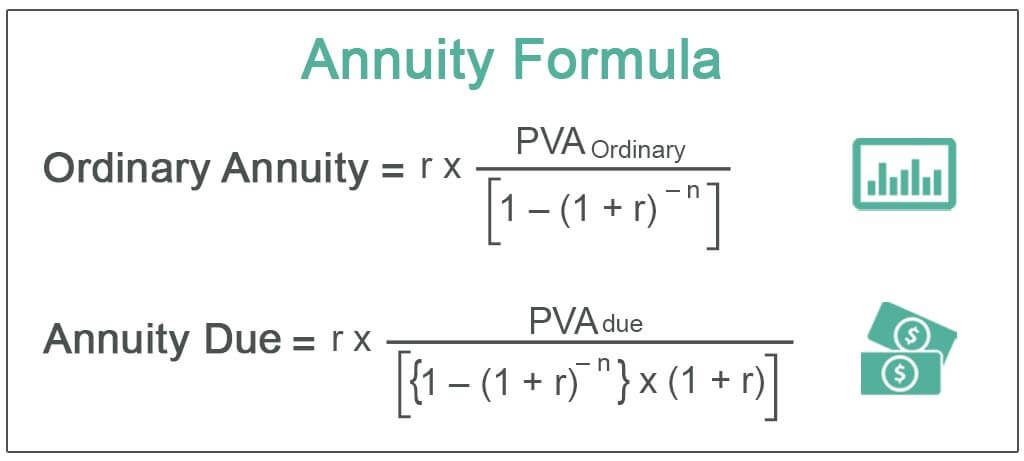

Skip to primary content. A regular annuity is simply an. An annuity formula is used to calculate either the future value FV or the present value PV of the annuity based on an discount rate i.

Of course as in the case of. By understanding the time value of money you can weigh the opportunity for growth against the. You can either receive 12000 now or 1200 monthly for the next 10 months.

Return On Investment ROI Calculator. In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of. PY periods per year.

N Number of compounding periods. Present value PV future value FV the value of the individual payments in each compounding period A. Annuity Calculator - Calculate Annuity Payments.

The calculation of time value of money TVM depends on the following inputs. An annuity running over 20 years with a starting principal of 25000000 and growth rate of 8 would pay approximately 209110 per. Ordinary annuity Annuity due Notes.

Time Value of Money Explained. N The number of years of compounding periods I The annual or periodic interest rate discount rate or rate of return PV.

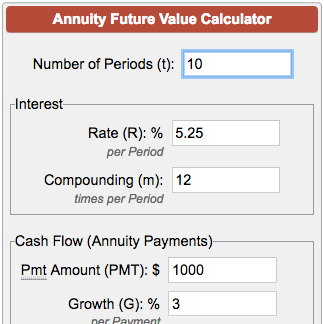

Future Value Of Annuity Calculator

Annuity Formula Annuity Formula Annuity Economics Lessons

Future Value Of An Annuity Calculator Inch Calculator

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

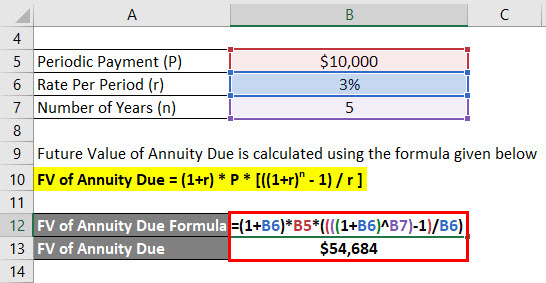

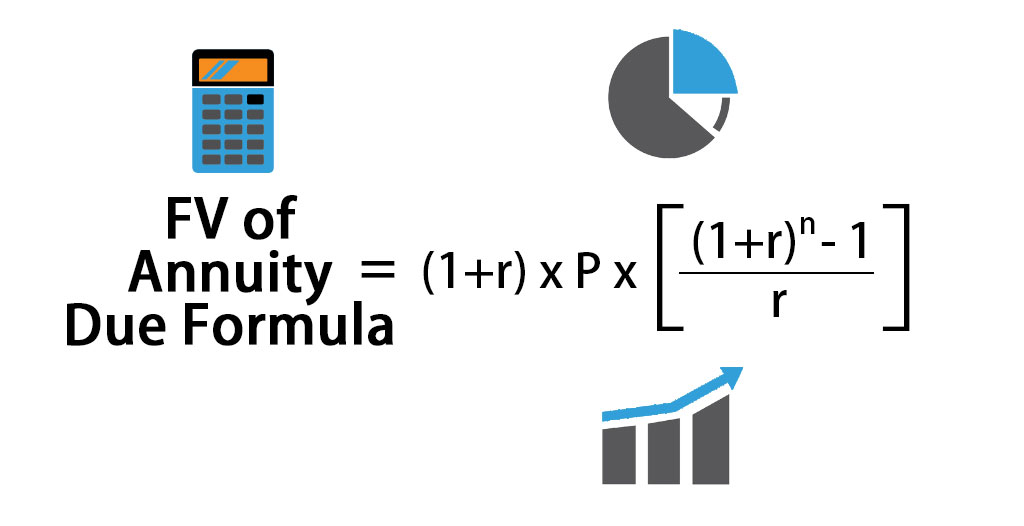

Future Value Of Annuity Due Formula Calculator Excel Template

Future Value Of Annuity Due Formula Calculator Excel Template

Future Value Of Annuity Calculator

Time Value Of Money Formulas Infographic Covering Perpetuity Growing Perpetuity Annuity Growing Time Value Of Money Accounting And Finance Finance Investing

Ex 2 Ti84 Tvm Solver Future Value Of An Annuity Youtube

Future Value Of Annuity Calculator

How To Calculate The Present Value Of An Annuity Youtube

Annuity Formula Calculation Of Annuity Payment With Examples

Future Value Annuity Calculator Calculate Fv Of Equal Cash Flows

Present Value Of An Annuity How To Calculate Examples

Future Value Of Growing Annuity Formula With Calculator

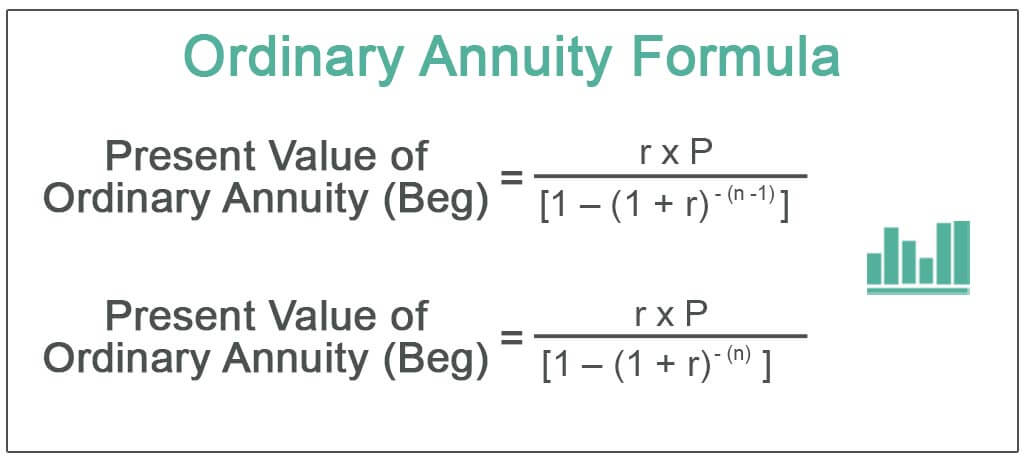

Ordinary Annuity Formula Step By Step Calculation